Mortgage Fraud 101 | The Section 2 Point and the Law Commission

Section 2 of the Law of Property (Miscellaneous Provisions) Act 1989 prescribes that:

2 Contracts for sale etc of land to be made by signed writing

(1) A contract for the sale or other disposition of an interest in land can only be made in writing and only by incorporating all the terms which the parties have expressly agreed in one document or, where contracts are exchanged, in each.(2) The terms may be incorporated in a document either by being set out in it or by reference to some other document.

(3) The document incorporating the terms or, where contracts are exchanged, one of the documents incorporating them (but not necessarily the same one) must be signed by or on behalf of each party to the contract.

In the absence of a single document which incorporates the terms and conditions and the signatures of both parties, the above provisions of section 2 render a mortgage contract void and unenforceable, save for the exceptions of those which have arisen through proprietary estoppel or constructive trust.

United Bank of Kuwait v Sahib & Others [1996]

By way of a compelling authority in support of this assertion, the learned Gibson LJ stated in United Bank Kuwait Plc v Sahib:

“The effect of section 2 is, therefore, that a contract for a mortgage of or charge on any interest in land or in the proceeds of sale of land can only be made in writing and only if the written document incorporates all the terms which the parties have expressly agreed and is signed by or on behalf of each party. […]

In the present case, for the reasons given, it seems to me clear that the deposit of title deeds takes effect as a contract for a mortgage and as such falls within s.2 […]

I therefore conclude that by reason of s.2, the mere deposit of title deeds by way of security cannot any longer create a mortgage or charge.”

Cousins Law of Mortgages

In addition, Cousins Law of Mortgage (2010) 3rd Edition affirms that:

“Where a purported contract for the grant of a mortgage on or after September 26, 1989 fails to comply with the requirements of section 2 of the Law of Property (Miscellaneous Provisions) Act 1989, no mortgage will be created and, notwithstanding any oral agreement or deposit of title deeds, the creditor will have no interest in or rights over the debtor’s land. […]

It follows that the failure to comply with section 2 will provide a defence to any claim for possession pursuant to a mortgage.” (page 610-611).

The Chitty Truth

Furthermore, Chitty (2008) 30th edition, page 417, clearly states:

“iii. The effect of failure to comply with formal requirements – Effect of non-compliance…any agreement not complying with the requirements of s2 of the 1989 Act is a nullity.”

This applies to mortgage contracts for the granting of a mortgage or charge in the future, which is the specie of agreement relied upon in the vast majority of UK mortgage transactions.

Herbert v Doyle [2010]

Proprietary estoppel and constructive trust cannot be reasonably claimed under such circumstances, as is confirmed by principles at the heart of the judgment of Lady Justice Arden (October 2010) Court of Appeal EWCA Civ 1095 in Herbert v Doyle:

“… In my judgment, there is a common thread running through the speeches of Lord Scott and Lord Walker. Applying what Lord Walker said in relation to proprietary estoppel also to constructive trust, that common thread is that, if the parties intend to make a formal agreement setting out the terms on which one or more of the parties is to acquire an interest in property … neither party can rely on constructive trust as a means of enforcing their original agreement.

In other words, at least in those situations, if their agreement (which does not comply with section 2(1)) is incomplete, they cannot utilise the doctrine of proprietary estoppel or the doctrine of constructive trust to make their agreement binding on the other party by virtue of section 2(5) of the 1989 Act …” (para #57)

The Law Commission’s Report

It was clearly the intention of Parliament, upon the recommendations of the Law Commission’s report, when it was considering the scope of section 2, that the provisions would apply to all but regulated mortgages, as was diligently considered in Sahib:

“Section 2 of the 1989 Act was enacted to give effect to the substance of that part of the Law Commission’s Report, Transfer of Land: Formalities for Contracts for Sale etc of Land (1987) (Law Com No 164), which recommended the repeal of s 40 of the Law of Property Act 1925 and the abolition of the doctrine of part performance and proposed new requirements for the making of a contract for the sale or other disposition of an interest in land.”

The Section 2 Point

The section 2 point which was sustained in the Sahib case in 1996, was duly affirmed by Lloyds V Bryant [1996, Murray v Guinness [1998] and Keay & Keay v Morris Homes [2012]:

No mortgage or charge will arise in the absence of a preceding section 2 compliant mortgage contract.

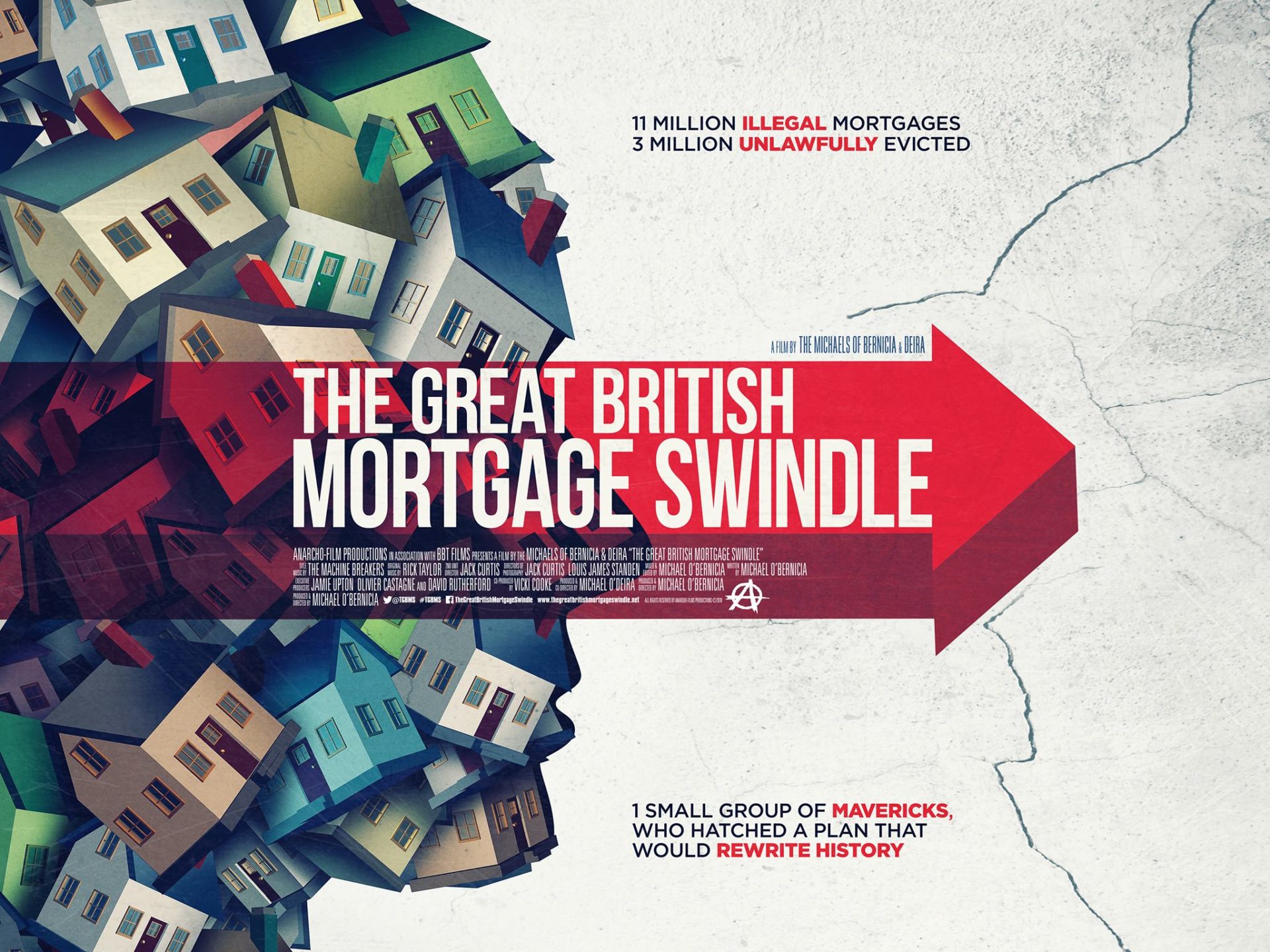

Indubitably, this formed the second of the TGBMS Grounds, upon which we are relying in the class actions to end UK mortgage fraud.

Related Links

Historic Judgment Which Changed Everything For UK Mortgagors

Bank Abandons Mortgage Possession Claim After Mortgagor Alleges Fraud

The Dawning of a New Day in the Fight Against Mortgage Fraud

Here Lies Yet More [Yes, More!] Incredible TGBMS News

BOOM! TGBMS Shakes The Room At The Land Registry

The People v The Banks: Representative Actions To End Mortgage Fraud

8 Steps To Cancelling Your Illegal Mortgage and Claiming Indemnity

Land Registry Confirms That No Mortgage Arises Without Legally Valid Documents

Mortgage Fraud 101: Summary of The TGBMS Grounds

Join The Unlawful Eviction Prevention Force

So You Want To Join The Class Actions To End UK Mortgage Fraud

TGBMS Links

Visit the official website for The Great British Mortgage Swindle:

https://www.thegreatbritishmortgageswindle.net

Watch on Amazon Prime:

https://www.amazon.co.uk/Great-British-Mortgage-Swindle/dp/B07L9WT5JM/

Buy the DVD on Amazon:

https://www.amazon.co.uk/Great-British-Mortgage-Swindle-DVD/dp/B07CXC36KG/

See the film in a UK cinema:

https://www.thegreatbritishmortgageswindle.net/book-cinema-tickets/