Mortgage Fraud 101 | The Section 1(3) Point and the Estoppel Issue

Referring to the proper making and delivery of mortgage deeds, section 1 (3) of the Law of Property (Miscellaneous Provisions) Act 1989 provides that:

“An instrument is validly executed as a deed by an individual if, and only if, (a) it is signed – (i) by him in the presence of a witness who attests his signature.”

Furthermore, it was affirmed by the Adjudicator in Garguilo v Jon Howard Gershinson & Anr [2012] EWLandRA 2011_0377 that the word it in this section must refer to the complete deed.

In other words, the entire document and not merely the execution page or any other page, must be signed in the presence of a witness, who must attest to the signature’s validity, as per the rules regarding the strict formalities for the execution and delivery of deeds, described by the learned Underhill J in R [Mercury Tax Group] v HMRC [2008].

Moreover, by way of section 52(1) Law of Property Act 1925, all conveyances of land are void for the purpose of creating a legal estate in land unless they are properly made by deed.

The Garguilo Case

In Garguilo, Mr and Mrs Garguilo submitted that even if the signatory pages of a disputed lease purportedly operating as a deed were, as found, executed separately and inserted into the lease at a later date, this invalidates the instrument as a matter of law.

The point had already been considered by Underhill J in Mercury, in which the claimants sought judicial review of the decision of HMRC to seek warrants to search their offices and the decision of the Crown Court to grant the warrants.

R [Mercury Tax Group] v HMRC [2008]

HMRC’s case was that the scheme (trust deed) in question was flawed and that the claimants sought dishonestly to conceal the flaws. The judge therefore had to consider whether the purported deed was flawed, as there were differences between the drafts and the final versions.

The court considered as an additional factor that each of the three key documents was intended to be a deed. Noting section 1(3) Underhill J said:

“Mr Bird submitted, and I agree, that that language necessarily involves that the signature and attestation must form part of the same physical document (the ‘it’) referred to at (a) which constitutes the deed.” [40].

He continued:

“I accept that the flaws on which HMRC rely are essentially formal. But I see nothing wrong in applying a strict test of formality to the validity of the agreements with which we are concerned in this case. The entire raison d’être is to create – and demonstrably to create – a series of formal legal relationships: if they do not do that, they do nothing.”

Landmark Decision

The Adjudicator in Garguilo therefore found that section 1(3) clearly provides that the signature and attestation must form part of the physical instrument at the moment of signing and that the policy argument is that the signature should reflect the proper agreement at the time of execution.

It was therefore held that if the signature is obtained separately from the attestation and/or from other documents that purportedly make up the deed, the maker of a disposition cannot be sure of the terms of the deed and the risk of fraud or mistake remains.

The question must always be whether a valid signature page and other relevant pages formed part of the same complete physical document at the moment of execution. That will be a question of fact in each case.

However, is also more than arguable that the same legal policy must be applied to mortgage deeds which are signed without being dated, which applies to every UK mortgage for the past five decades.

No Estoppel

Somewhat inevitably, the issue of estoppel was raised by the respondents in opposition to the Garguilo points.

However, it was held that the lack of a (valid) signature could not be cured by raising the issue of estoppel.

This point was confirmed by principles at the heart of the judgment of Lady Justice Arden in Herbert -v- Doyle (October 2010):

“Applying what Lord Walker said in relation to proprietary estoppel also to constructive trust… if the parties intend to make a formal agreement setting out the terms on which one or more of the parties is to acquire an interest in property … neither party can rely on constructive trust as a means of enforcing their original agreement. In other words, at least in those situations, if their agreement (which does not comply with section 2(1)) is incomplete, they cannot utilise the doctrine of proprietary estoppel or the doctrine of constructive trust to make their agreement binding on the other party by virtue of section 2(5) of the 1989 Act …” (para #57).

Binding Precedent

Having consistently argued these points from October 2010, on the 21st of July 2014, my family’s property trust’s defence of a ~Bank of Scotland claim for an allegedly outstanding £1.87 M was emphatically sustained before HHJ Behrens at Leeds High Court.

Behrens declared that the trustees were not estopped from relying upon the argument that a mortgage deed is illegal and void, if it fails to comply with the provisions of section 1(3) of the Law of Property (Miscellaneous Provisions) Act 1989, under section 52(1) of the Law of Property Act 1925.

This High Court ruling immediately became binding on all mortgage-related proceedings and is cited as Bank of Scotland plc v Waugh & Others [2014].

The main point that was taken in our case became known as the Section 1(3) point. It also provided the first of the TGBMS Grounds, in our on-going class actions to end UK mortgage fraud.

Related Links

Historic Judgment Which Changed Everything For UK Mortgagors

Bank Abandons Mortgage Possession Claim After Mortgagor Alleges Fraud

The Dawning of a New Day in the Fight Against Mortgage Fraud

Here Lies Yet More [Yes, More!] Incredible TGBMS News

BOOM! TGBMS Shakes The Room At The Land Registry

The People v The Banks: Representative Actions To End Mortgage Fraud

8 Steps To Cancelling Your Illegal Mortgage and Claiming Indemnity

Land Registry Confirms That No Mortgage Arises Without Legally Valid Documents

Mortgage Fraud 101: Summary of The TGBMS Grounds

Join The Unlawful Eviction Prevention Force

So You Want To Join The Class Actions To End UK Mortgage Fraud

TGBMS Links

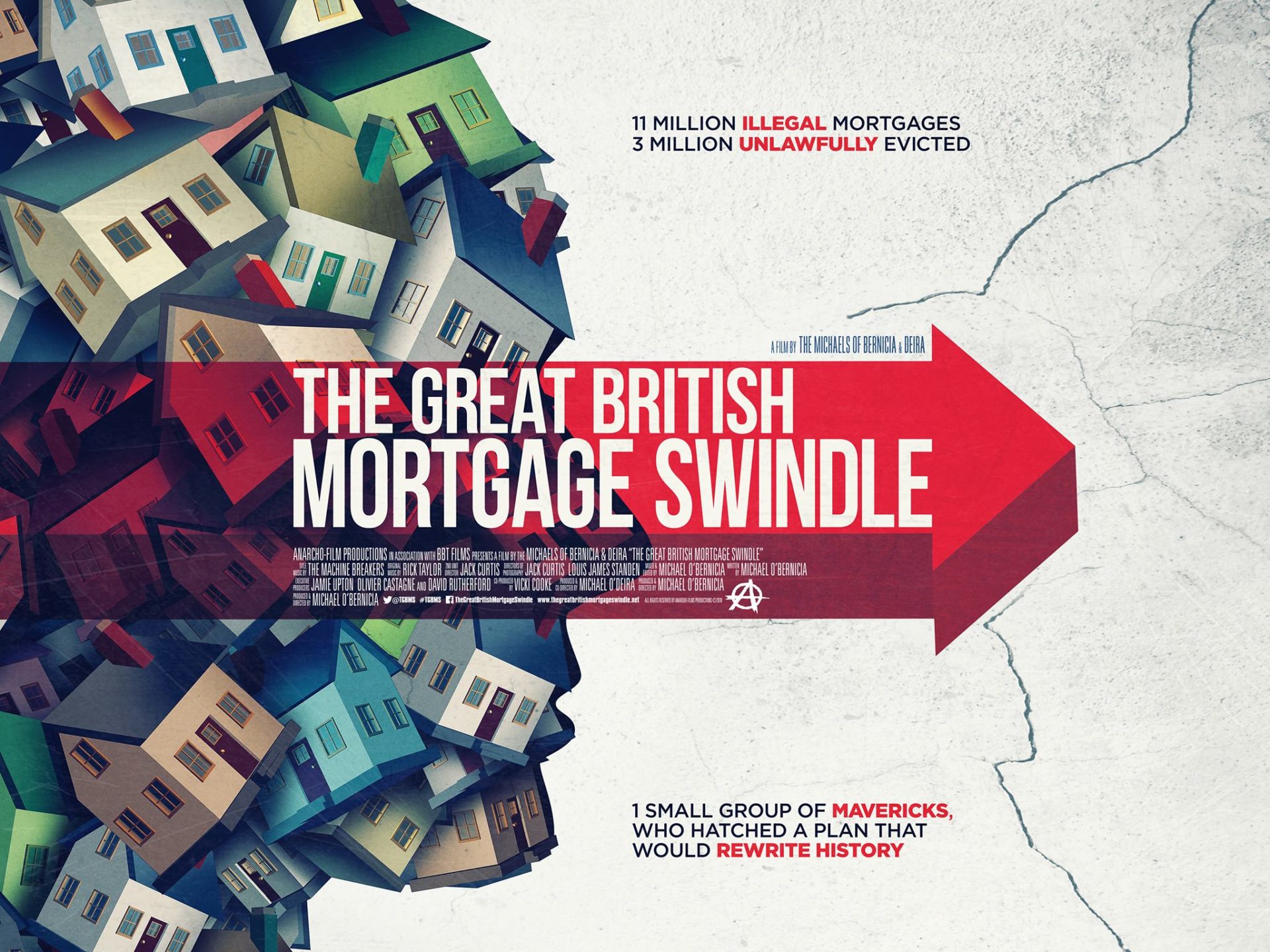

Visit the official website for The Great British Mortgage Swindle:

https://www.thegreatbritishmortgageswindle.net

Watch on Amazon Prime:

https://www.amazon.co.uk/Great-British-Mortgage-Swindle/dp/B07L9WT5JM/

Buy the DVD on Amazon:

https://www.amazon.co.uk/Great-British-Mortgage-Swindle-DVD/dp/B07CXC36KG/

See the film in a UK cinema:

https://www.thegreatbritishmortgageswindle.net/book-cinema-tickets/