Totally Without Merit – The Defendants’ Arguments

Here lie the arguments that will almost certainly be thrown at us in the class actions by the defendants, as written by a man who I mistook as a loyal and trusted friend and the barrister he took advice from on the veracity of the TGBMS Grounds, which I rebut below, point for point.

Dramatic Over Simplification of the TGBMS Grounds

“Michael has dramatically over simplified the case to the point of ignoring some vital information. A loss in court, cannot be made into a victory by the say-so of the loser no matter what outcomes are further down the line.”

I have, indeed, dramatically simplified the mechanics of mortgage fraud, in order that anybody can understand it. However, the allegation that I have simplified things at the expense of vital information is founded on the fatally flawed presumption expressed in the following point:

“1) Michaels claim that the Terms and Conditions being required to be in ONE COMPLETE document is entirely wrong, The LPMPA 1989 S2(s) clearly states;

“(2)The terms may be incorporated in a document either by being set out in it or by reference to some other document.”

As stated clearly in The Great British Mortgage Swindle and in numerous public speaking I have done on the subject, under section 2, the terms and conditions of the mortgage can be incorporated in a separate document referred to in the mortgage contract. The allegation that I have overlooked the provision is proven to be without merit on this basis alone.

This omission from their reasoning, however, also reveals their point to be based on an invalid presumption, which I have argued away, in and out of court, with this simple rebuttal:

The document referred to was never seen by the mortgagor prior to signature of the alleged contract which purported to incorporate its terms, thereby rendering it [the contract] void for failing to actually do so under section 2, by and through the mortgagee’s failure to disclose the terms of the contract before signature by the mortgagor.

Pretending a Win is a Loss

The point that a loss in court can’t be turned into a victory by the say-so of the loser is a moot one at best, since we didn’t lose. In fact, we won the section 1 and the powers of attorney point.

Then the Land Registry was then ordered by the Property Chamber to cancel the void mortgage over Ashquorn House, which happened in January 2015.

Whilst the other aspects of HHJ Behrens’ judgment were held to be void ab initio, when BOS gave up its arguments that it was owed £2.5 M from my family and the LR cancelled the last remaining mortgage over the Nelson Trust portfolio, in February 2019.

So when there were still valuable properties they could steal from my family, they give up their claim, made my sister and parents mortgage free and due substantial compensation. Yet our adversaries are accusing me of distorting the facts by pretending we won, when the actual facts, as documented in TGBMS and on this blog, speak for themselves.

Nevertheless, they dug an even bigger pit of foolish assumptions for themselves to wallow in with their next fallacious point.

The Section 1 Point

“On the “deed”, there will be such a reference to another document along the likes of “HBOS Terms and Conditions 2007” BUT…If the document is titled “HBOS Terms and Conditions Autumn 2007″ then THAT IS NOT CORRECT and it COULD be argued that S2(s) applies, otherwise this point WILL fail in court.”

This is tantamount to proposing that the section 1 point, regarding the invalid attestation to the signature on the deed, which is binding on all mortgage related proceedings because we proved it in Bank of Scotland plc v Waugh & Others [2014], should be set aside and replaced with the argument that section 2 applies to deeds.

That defeated argument was made and lost in Helden v Strathmore [2011], in which Lord Neuberger affirmed that section 2 ONLY applies to mortgage contracts and that section 1 ONLY applies to mortgage deeds.

In other words, the point is totally without merit in every respect and it is the umpteenth time I have heard it over the past ten years, but it gets more ridiculous every time anybody tries to resurrect it.

Stand-Alone POA Deed Required

“2) Michaels claim that the Power of Attorney can ONLY be donated by a SEPARATE “deed”, again, FALSE, the mortgage “deed” is the ONLY deed required as a “deed” can encompass many statements on its face and there is NO MENTION of a requirement for a separate “deed” in the Power of Attorney Act 1971 which states’; “An instrument creating a power of attorney shall be the donor of the power”. Reading through the entire Act there is NO requirement for a separate deed. HOWEVER..

There is an argument that the person who signs the mortgage “deed” was NEVER made aware they were donating Power of Attorney and so despite the act that the banks CLAIMS PoA, there is never full disclosure and so the PoA could be challenged on those grounds.”

The Power of Attorney point was conceded by Bank of Scotland’s barrister, prior to the hearing on 21/07/2014 in our case, on the very ground they cite as being false – that the “instrument” referred to in the statute must be both properly made and delivered as a deed and knowingly executed by the donor of the powers.

In other words:

a. The instrument must be signed by the donor of the powers of attorney, in the presence of an independent witness, who must attest the signature, otherwise it is illegal and void under section 52(1) of the Law of Property Act 1925.

b. The donation of the powers must be clearly expressed within the deed, which must comply with the provisions of the Powers of Attorney Act 1971.

c. Since there is no express grant of any powers of attorney by the mortgagor in any mortgage deed, it simply cannot be successfully argued that a clause in a mortgagee’s Standard Mortgage Conditions purporting to create powers of attorney takes any legal effect without a separate stand-alone instrument, which must be knowingly executed by the donor of such powers, as well as being properly made and delivered as a deed.

d. The Standard Mortgage Conditions are neither registered or unregistered instruments granting powers of attorney.

This position is entirely supported by the relevant chapters in Halsbury’s Laws of England, which Bank of Scotland’s barrister quoted to HHJ Behrens, when he withdrew the bank’s application for a declaration that they had the right to create a new charge over Ashquorn House, under the purported POA granted in the Standard Mortgage Conditions.

The reason so few people are currently aware of this is because Behrens was not obliged to include the POA point, as it was won out of court, just before the summary judgment hearing in which we won the section 1 point at Leeds High Court.

However, everybody who has seen TGBMS is bereft of excuses for not knowing that we also won the powers of attorney point before the hearing

Shah v Shah is Distinguishable from the Class Actions

“3) Most if not all the cases will come up against the Shah v. Shah argument which is a bank favourite. In this case three people colluded to defraud the bank, having discovered (as we have) the LPMPA S1(3). They hatched a plan that the “witness” would agree that he had NOT been present at the time of signing by the two parties.

The case failed as they had NO EVIDENCE that the witness (who was already KNOWN to them and thus was NOT a truly “independent party” had not been present and so, with the “deed” correctly executed “ON THE FACE OF IT” the judge effectively called their bluff on the scam and they lost. So, UNLESS there is SOLID evidence which casts SERIOUS doubt as the actual execution of the “deed” then most cases will fall on this ruling.”

This case was relied upon by BOS in every set of fraud proceedings we brought against them. It fell down because we DID produce sufficient evidence.

Furthermore, that is exactly what EVERYBODY in the class actions is expected to do, in the form of truly independent witness testimony [if that exists]; and their own testimony, plus supporting evidence, in all other cases.

Nevertheless, our mass claims can easily be distinguished from Shah v Shah because nobody has or will dishonestly conspire to defraud the banks out of compensation for mortgage fraud, which was the key element in that case, on the ground that such frauds vitiated all other rights the mortgagors might otherwise have been able to enforce.

In no way can that be said about any of the claims we have or will initiate.

Endemic Fraud

Furthermore, another distinguishing feature of the class actions to end mortgage fraud is our argument that the solicitor adding the date to the deed on the day of the completion of the purchase of the property concerned, rather than the deed having been dated by the mortgagor at the moment of execution, renders it a forgery at registration.

Doing so also comprises a material alteration of the deed, on the ground that an undated deed cannot be registered by the Land Registry.

It is therefore obvious my critics have conveniently overlooked the fact that, in the majority of cases, the solicitor [or somebody pretending to have authority] illegally attests to the execution of the deed without actually witnessing the signature.

Furthermore, they clearly have no idea of the extent of signature forging on the documents the banks are relying upon in court. In the alternative, they might be deliberately overlooking that fact, despite the announcement by the Treasury that it is now being formally investigated because of the abundance of evidence which proves that signature fraud is endemic across the entire UK mortgage industry.

In just two cases I am aware of, a highly respected ex CID detective has found 130 examples of signature fraud on the documents submitted by the banks’ lawyers, in their two fraudulent mortgage possession claims. This is just the tip of the iceberg.

Tenuous Arguments Cannot Be Technically Correct

“The interpretation of the other cases Michael cites are tenuous at best, and whilst “TECHNICALLY” correct, will need a good deal of explanation by a VERY competent person in court as to how they now apply and a relevant when they were thrown out so many times before (this is the “Failed before, how come they now apply because you won a case on a DIFFERENT argument” scenario, and I know the banks and Land registry are intending to tear these claims wide open if we give them the slightest chance, and I mean the SLIGHTEST chance.”

Now far be it from me to suggest that legal professionals might be under-furnished in the brain department, but it is a plain contradiction in terms to state that my interpretation of the authorities upon which we rely is “tenuous at best” and then in the same sentence, describe such interpretation as “TECHNICALLY correct”.

In truth, I can’t quite believe I’m having to point out that tenuous [meaning insubstantial] interpretations [or arguments] cannot also be technically correct [meaning substantial].

It is abundantly obvious that the interpretation of the binding precedents will need a good deal of explanation from a “VERY competent person in court”.

However, making that statement overtly implied that I am not competent enough to do so, in spite of the indisputable fact that I have a 100% track record in nailing legal arguments before a coterie of senior judges.

In addition, it never matters how much my adversaries spend on legal representation because I never start any proceedings unless I already know for a fact that my arguments are already won.

The Facts Speak For Themselves

In February this year, BOS gave up its claim for £2.5 M and cancelled the last remaining void mortgage over my sister’s property, when the net value of my parents’ and sister’s homes was at least £1.35 M.

If my arguments were wrong, they would never have done so and those properties would have been fire-sold like nine others have been. It really is as simple as that.

For such harsh criticisms of the TGBMS Grounds to be justified, they had to be right on the money, but I have easily rebutted their arguments in just a few precise sentences because the points raised are almost identical to the arguments that led BOS to capitulate on every point in our case.

I could do that uni-cycling blindfolded on a tightrope over the River Tyne, whilst singing The Land Was Stolen.

As long as the legal professions stick to those arguments, they haven’t got a chance in hell of winning. So long may it continue.

Related Links

Historic Judgment Which Changed Everything For UK Mortgagors

Bank Abandons Mortgage Possession Claim After Mortgagor Alleges Fraud

The Dawning of a New Day in the Fight Against Mortgage Fraud

Here Lies Yet More [Yes, More!] Incredible TGBMS News

BOOM! TGBMS Shakes The Room At The Land Registry

The People v The Banks: Representative Actions To End Mortgage Fraud

8 Steps To Cancelling Your Illegal Mortgage and Claiming Indemnity

Land Registry Confirms That No Mortgage Arises Without Legally Valid Documents

Mortgage Fraud 101: Summary of The TGBMS Grounds

Join The Unlawful Eviction Prevention Force

TGBMS Links

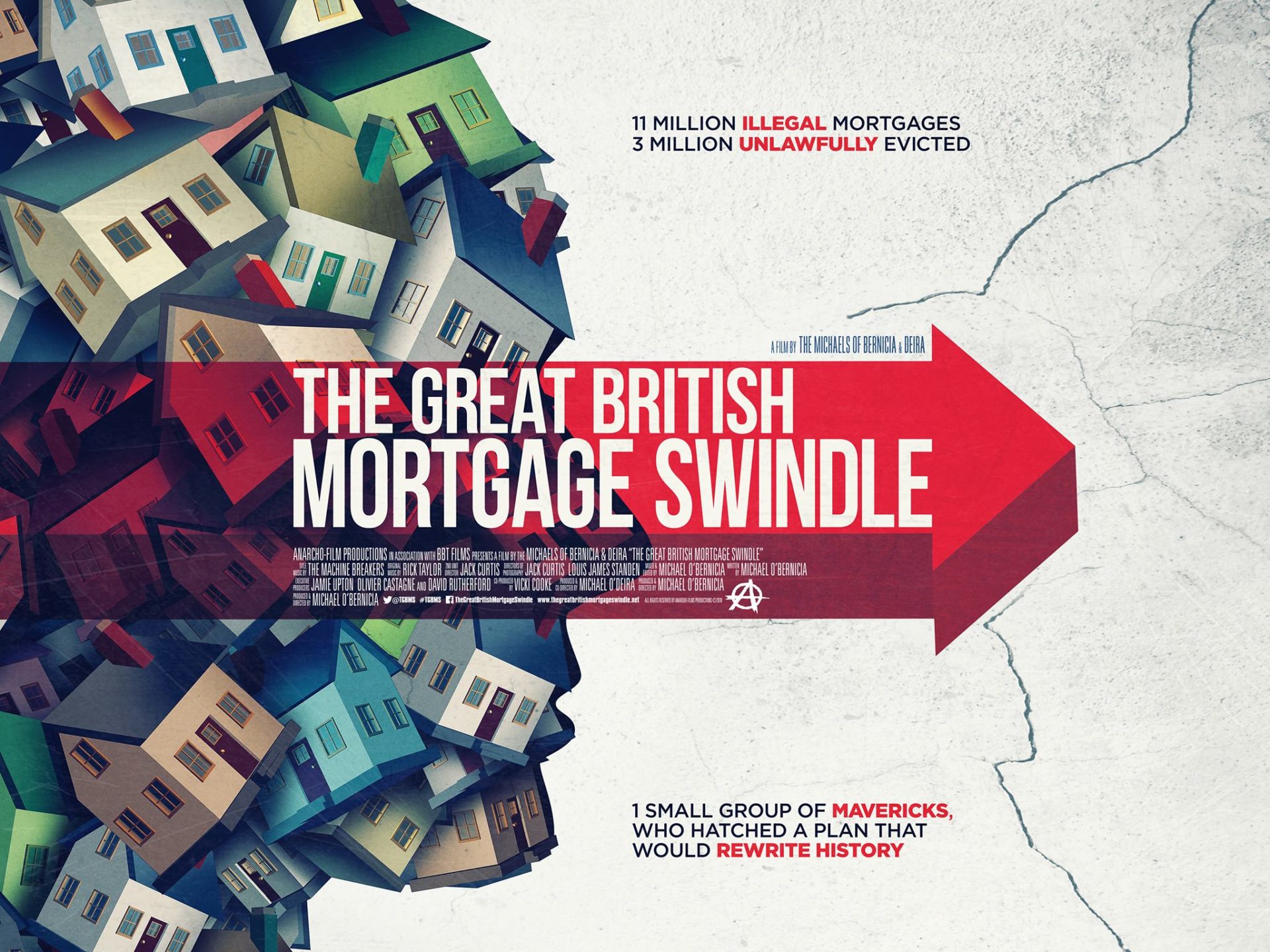

Visit the official website for The Great British Mortgage Swindle:

https://www.thegreatbritishmortgageswindle.net

Watch on Amazon Prime:

https://www.amazon.co.uk/Great-British-Mortgage-Swindle/dp/B07L9WT5JM/

Buy the DVD on Amazon:

https://www.amazon.co.uk/Great-British-Mortgage-Swindle-DVD/dp/B07CXC36KG/

See the film in a UK cinema:

https://www.thegreatbritishmortgageswindle.net/book-cinema-tickets/