Mortgage Fraud 101: Rebutting The Undefendable

As those fighting mortgagor possession proceedings with the TGBMS Grounds will already know, the most common reaction from banksters, their lawyers and the Land Registry, is to attempt to implicitly justify the undefendable with the following loaded question:

“Did you get receive a loan of monies after signing the mortgage deed?”

However, this undefendable position can [and has been] successfully rebutted by answering that question with the following points, whether in long or short form.

Long Form

1. There was no loan of monies, as proven by Professor Werner’s empirical research into the subject of money creation.

In fact, the deposit by the bank of a signed mortgage offer letter [promissory note] created the funds, which the mortgagee then pretended to loan to the mortgagor.

2. In any event, the deed is void because it was signed before completion of purchase, as per the binding Supreme Court decision, Scott v Southern Pacific Mortgages [2014] – nobody has a legal or equitable right to grant an interest over a property before they own it.

3. The mortgage deed is illegal and void under section 52(1) of the Law of Property Act 1925, for failing to comply with section 1 of the Law of Property (Miscellaneous Provisions) Act 1989, as per the binding high court decision in Bank of Scotland plc v Waugh & Others [2014].

4. As there is no valid mortgage contract which complies with section 2 of the 1989 Act, no mortgage was capable of arising, as per United Bank of Kuwait v Sahib & Others [1996].

5. The Land Registry must therefore cancel the mortgage as a mistake in the register, under the provisions of section 6 of schedule 4 of the Land Registration Act 2002 – alterations that can be taken without a court order.

6. The Chief Land Registrar must also indemnify the void mortgagor for all the losses incurred, as a direct result of the fraudulent entry in the register, as per the Swift 1st Ltd decision – the CLR must indemnify anybody who suffers losses as a direct result of an entry [or omission] in the register.

Short Form

In a bullet-point summary of the facts described above:

a. There was no loan.

b. There is no valid deed.

c. There is no enforceable contract.

d. There is no equitable or legal mortgage.

e. The bank fraudulently registered the transaction.

f. The void mortgagor is owed compensation for the losses incurred.

Words To The Wise

Fighting mortgage fraud is not for the faint-hearted.

If possible, never go into default, so that there is no chance that your property can be stolen during mortgage possession proceedings.

However, if you are in default, this method can still be applied, but not without the risk of your property being seized by bailiffs.

In any event, stand your ground, stay calm and repeat the grounds like a mantra, until all resistance falls away and no matter how long it takes.

Understand that nothing worth having is easy to come by.

Until the magical silver bullet for mortgage fraudsters has been cast and loaded, be prepared for a war of attrition.

However, always take heart from the fact that these arguments forced Bank of Scotland to give up its fraudulent claim for £2.5M against my family, after almost a decade of bitter legal battles.

Related Links

Historic Judgment Which Changed Everything For UK Mortgagors

Bank Abandons Mortgage Possession Claim After Mortgagor Alleges Fraud

The Dawning of a New Day in the Fight Against Mortgage Fraud

Here Lies Yet More [Yes, More!] Incredible TGBMS News

BOOM! TGBMS Shakes The Room At The Land Registry

The People v The Banks: Representative Actions To End Mortgage Fraud

8 Steps To Cancelling Your Illegal Mortgage and Claiming Indemnity

Mortgage Fraud 101: The Conditional Acceptance Process

TGBMS Links

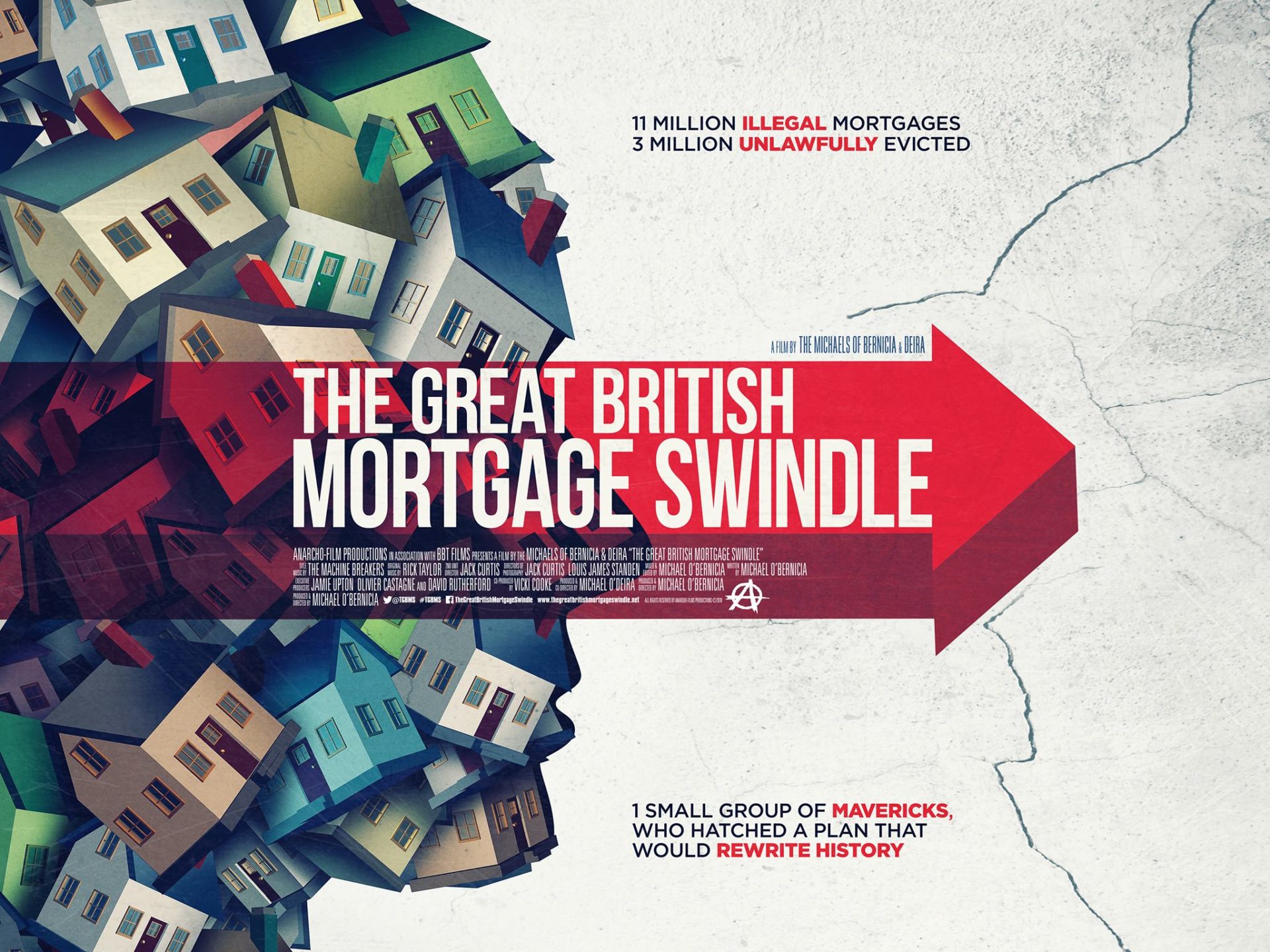

Visit the official website for The Great British Mortgage Swindle:

https://www.thegreatbritishmortgageswindle.net

Watch on Amazon Prime:

https://www.amazon.co.uk/Great-British-Mortgage-Swindle/dp/B07L9WT5JM/

Buy the DVD on Amazon:

https://www.amazon.co.uk/Great-British-Mortgage-Swindle-DVD/dp/B07CXC36KG/

See the film in a UK cinema:

https://www.thegreatbritishmortgageswindle.net/book-cinema-tickets/