Mortgage Fraud 101: The Conditional Acceptance Process

In the event I was beginning a process of discovery, in relation to ascertaining whether my mortgage was illegal and void, I would begin with the following conditional acceptance process.

Notice of Conditional Acceptance

Dear Mortgage Bandit [Add Real Name].

Re: Account Number ##########

With reference to your claim for mortgage monies in relation to the above account, I hereby conditionally accept the alleged debt and agree to settle it in the most expedient manner possible, upon receipt of the following items:

1. A mortgage deed which was properly executed in accordance with section 1 of the Law of Property (Miscellaneous Provisions) Act 1989.

2. A mortgage contract which complies with section 2 of the LPMPA 1989.

3. A certified copy of both sides of your accounting ledger, verifying that the funds for the purported loan were not created by the deposit of the signed Mortgage Offer Letter in the bank’s account.

4. A letter from your solicitors explaining why mortgages are exempt from the effect of the Scott v Southern Pacific Mortgages judgment – nobody has the right to grant any legal of equitable interest over a property before they own it.

5. A letter from your solicitors explaining why adding the date to the deed after it was executed did not constitute a material alteration.

Please provide these items to the address related to this account within the next 14 days.

Yours sincerely,

[Add Real Name]

Once served by recorded mail, it is highly likely that you don’t receive a response of any nature, save for the usual correspondence you receive from the bank.

In which case, I would reply as follows:

Notice of Opportunity To Cure

Dear Mortgage Bandit [Add Real Name].

Re: Account Number ##########

Following your failure to reply to my Notice of Conditional Acceptance dated [Add Date], I hereby serve Notice of Opportunity To Cure, requiring you to provide me with the following items without any further delay:

1 A mortgage deed which was properly executed in accordance with section 1 of the Law of Property (Miscellaneous Provisions) Act 1989.

2 A mortgage contract which complies with section 2 of the LPMPA 1989.

3 A certified copy of both sides of your accounting ledger, verifying that the funds for the purported loan were not created by the deposit of the signed Mortgage Offer Letter in the bank’s account.

4 A letter from your solicitors explaining why mortgages are exempt from the effect of the Scott v Southern Pacific Mortgages judgment – nobody has the right to grant any legal of equitable interest over a property before they own it.

5 A letter from your solicitors explaining why adding the date to the deed after it was executed did not constitute a material alteration.

Please provide these items to the address related to this account within the next 14 days.

Failure to do so, for any reason whatsoever, will result in the legal presumption that the alleged debt cannot be verified or validated.

Yours sincerely,

[Add Real Name]

This time you will almost certainly receive a response, which will not include any of the items required to legally verify the fraudulent debt.

At which point, I would issue the following notice:

Notice of Default

Dear Mortgage Bandit [Add Real Name].

Re: Account Number ##########

Following your repeated failures to legally verify or validate the alleged debt associated with the above account, I hereby serve Notice of Default.

Please be advised that the purported mortgage is a legal and equitable nullity, for the following reasons:

1 There is no mortgage deed which was signed in the presence of an independent witness, in breach of section 1(3) of the LPMPA 1989, as per Bank of Scotland plc v Waugh & Others [2014].

2. There is no mortgage contract that was signed by both the mortgagor and the mortgagee, containing all of the terms and conditions in a single document, in breach of section 2 of the LPMPA 1989, in accordance with the Court of Appeal judgment given in Sahib v United Bank of Kuwait [1996].

3. The purported funds for the loan were created by the deposit of the signed Mortgage Offer Letter in the bank’s account.

4. The mortgage deed was signed before completion of purchase, as per Scott v Southern Pacific Mortgages judgment – nobody has the right to grant any legal of equitable interest over a property before they own it.

5. The conveyancing solicitor materially altered the deed by adding a date that was subsequent to its execution, since an undated deed is incapable of registration as a legal mortgage by the Land Registry.

I will now commence any and all necessary proceedings to claim back the losses I have incurred by way of this plainly fraudulent transaction.

Yours sincerely,

[Add Real Name]

Regardless of whether the mortgage bandit throws in the towel or issues proceedings against you, this is the foundation from which we won our decade long battle with Bank of Scotland, which gave up its £2.5M fraudulent claim against my family in February 2019.

Related Links

Historic Judgment Which Changed Everything For UK Mortgagors

Bank Abandons Mortgage Possession Claim After Mortgagor Alleges Fraud

The Dawning of a New Day in the Fight Against Mortgage Fraud

Here Lies Yet More [Yes, More!] Incredible TGBMS News

BOOM! TGBMS Shakes The Room At The Land Registry

The People v The Banks: Representative Actions To End Mortgage Fraud

8 Steps To Cancelling Your Illegal Mortgage and Claiming Indemnity

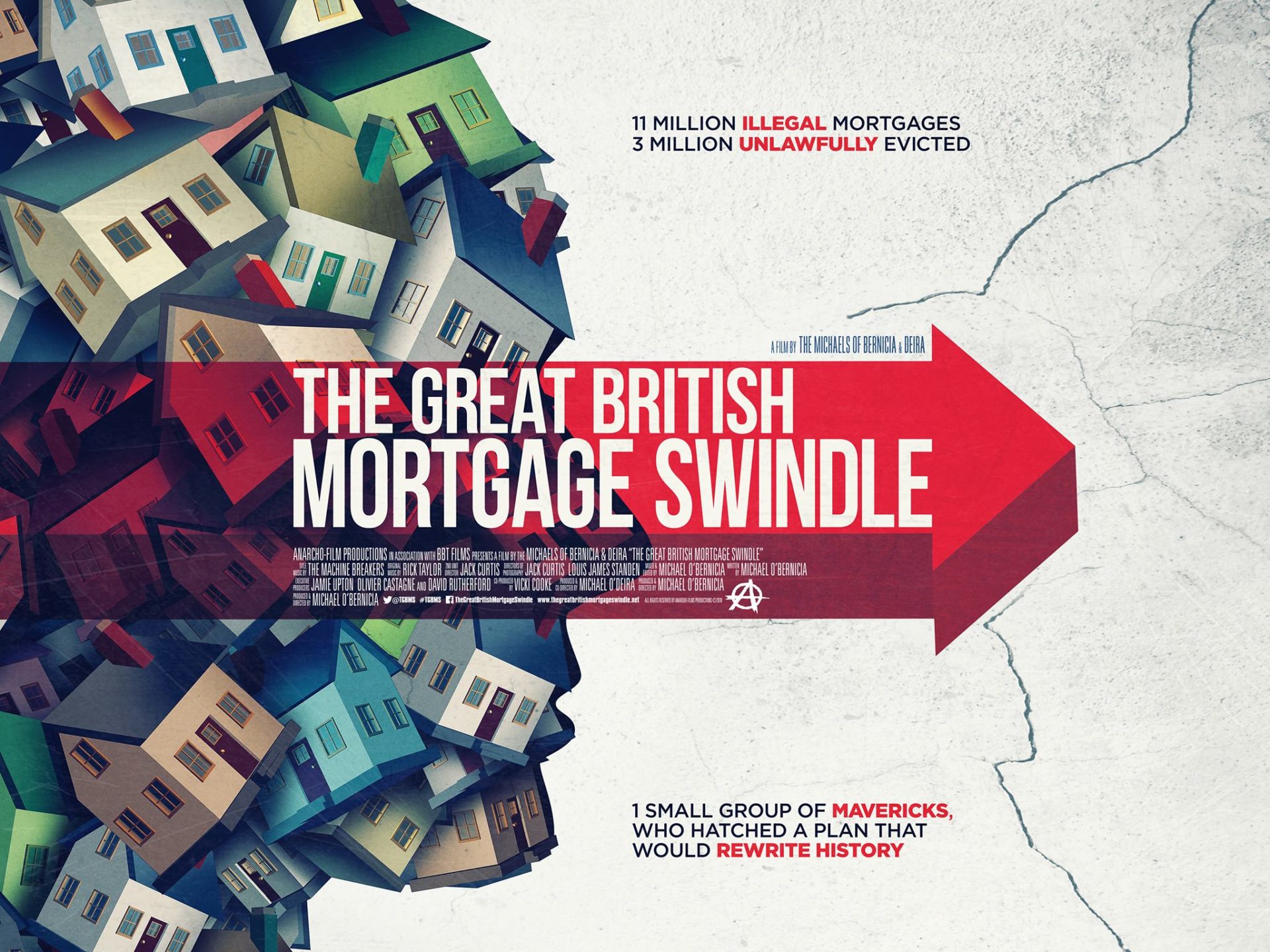

TGBMS Links

Visit the official website for The Great British Mortgage Swindle:

https://www.thegreatbritishmortgageswindle.net

Watch on Amazon Prime:

https://www.amazon.co.uk/Great-British-Mortgage-Swindle/dp/B07L9WT5JM/

Buy the DVD on Amazon:

https://www.amazon.co.uk/Great-British-Mortgage-Swindle-DVD/dp/B07CXC36KG/

See the film in a UK cinema:

https://www.thegreatbritishmortgageswindle.net/book-cinema-tickets/